June 28, 2022

Washington’s cowardly proxy war against Russia reached a new level of absurdity over the weekend.

To wit, the G-7 knuckleheads declared an embargo on imports of Russia-sourced gold and forced Russia into technical default on its foreign debts by forbidding US companies from collecting the payments which Russian debtors had deposited in their accounts at non-sanctioned Russia banks.

In a word, ordinary commerce has become so weaponized by Washington that the world’s oldest money can no longer be freely exchanged on international markets. At the same time, interest payments made in good faith by Russian borrowers have been effectively seized and frozen in place by the US government.

And yet, where are the free enterprise Republicans?

Answer: So intoxicated with neocon-instigated war fevers that they are willing to subordinate the fundamental rights of US private property owners and traders to the pursuit of a Sanctions War against Russia – a "war" that has not been declared by Congress and that has nothing whatsoever to do with the liberty and security of the American homeland.

Indeed, the Washington-forced "default" is so preposterous as to suggest that officialdom has taken total leave of its senses. As it happens, Russia last week codified plans to pay bondholders in rubles under a decree signed by President Putin.

Under it terms, Russia sent ruble payments to accounts for foreign bondholders at unsanctioned Russian banks. Foreign investors were then authorized to freely convert the rubles into dollars or other foreign currencies, thereby receiving payment for 100% of the due amounts and in a form specified by the lending agreements.

In fact, the Russian Finance Ministry said it made roughly $400 million in such payments on Thursday and Friday to bondholders under the new mechanism. So there was actually no real borrower "default" about it.

Yet US and other western bondholders will struggle to move the money out of Russia without breaching Western sanctions. That’s because these payments must pass through Russia’s National Settlement Depository, which has been sanctioned by the European Union, while the U.S. has barred American banks from processing Russian debt payments since late May.

So, if that isn’t outright theft of property we don’t known what is. The US Treasury has effectively stolen $400 million of private property so that the Sunday afternoon warriors on the banks of the Potomac can pretend to make war on Russia, even as they encourage the bantam-weight now in charge of the Kiev government to send tens of thousands of Ukrainian soldiers and civilians to their deaths for no rational purpose whatsoever.

It should be evident by now that Ukraine has lost the war and that it is only a matter of time before they are forced to sue for peace and give-up the eastern and southern territories of what was historically known as "Novorussiya", stretching from Kharkiv to Odessa. That is, these territories had been part of Russia for more than 200 years until the evil trio of Soviet history – Lenin, Stalin and Khrushchev – appended them to a totalitarian administrative unit known as the Ukraine Soviet Socialist Republic between 1922 and 1954.

But so what? All the vast destruction and loss of life which has transpired since February 24th could have been avoided had Zelensky’s fantasy of joining NATO, his brutal attacks on the Donbas separatists and his plans to recapture Crimea been shutdown by Washington before the Russian invasion.

Five months later, however, the man has become even more delusional and genocidal, while Washington officials merely stand idly to the side holding his coat. As he told the G-7 over the weekend,

The Ukrainian leader told the G-7 leaders that now wasn’t the moment to negotiate with Russia. "Ukraine will negotiate when it is in a position to, that’s to say when it will have re-established a strong position," the Ukrainian president said, according to a French official.

(As usual) Ukrainian President Volodymyr Zelensky told Group of Seven leaders he needs more support from allies to push Russia out of newly conquered territories before cold weather allows the invaders to consolidate their gains, according to an official present for the video address.

Ukraine requires more military, political and financial support from G-7 countries to conclude the war before the end of the year and push Russia back to the separation line before the February invasion, Mr. Zelensky said Monday, according to this and other officials.

In truth, there is not a snowball’s chance in the hot place of that happening. What lies ahead is more months of Washington’s cynical meat-grinder. Much of Ukraine has been turned into a Weapons Demolition Derby – a place where US and NATO stockpiles can be destroyed in the long, hazardous transit from the Polish border to the eastern front or in battle itself – so that Raytheon et. al. can get replenishment orders forthwith.

But what won’t emerge from this cruel insanity is a "stronger" Ukrainian military position. Nor, for that matter, even a fig leaf of vindication for Washington’s demented strategy of wantonly sacrificing Ukrainian bodies and economic infrastructure in its pointless proxy war against Russia.

Meanwhile, the Sanctions War has been a near total failure. For instance, India has materially increased its purchases of Russian oil this year after securing deals with Moscow to get it at a deep discount to market prices. And we don’t mean just an ordinary fractional increase like 10% or even 25%.

No, the country bought an average of 1 million barrels a day in June, compared with 30,000 barrels per day in February, according to Kpler data. That’s a 33X gain in four months!

Stated differently, that moves India’s purchases from a rounding error a few months ago to the equivalent of more than a quarter of Europe’s purchases, according to International Energy Agency data.

Needless to say, the displacement of Russia energy export sales to newfound homes in India, China and among other developing world buyers has made mincemeat of Washington’s economic punishment strategy. In fact, Russia’s revenues from fossil fuels, by far its biggest export, soared to records in the first 100 days of its war on Ukraine, driven by a windfall from oil sales amid surging prices.

During that period, Russia earned a record $97 billion in revenue from exports of oil, gas and coal, according to data analyzed by the Center for Research on Energy and Clean Air based in Helsinki, Finland. About two-thirds of those earnings came from oil, and most of the remainder from natural gas.

"The current rate of revenue is unprecedented, because prices are unprecedented, and export volumes are close to their highest levels on record," said Lauri Myllyvirta, an analyst who led the center’s research.

Not surprisingly, when it comes to the G7 weekend special with respect to the gold embargo, the biggest buyers of gold in recent years have not been the G7 countries (United States, France, Canada, Germany, Japan, the United Kingdom and Italy). Many of the latter, in fact, naively sold much if not all their gold in the recent past and have refused or simply don’t have the funds to restock.

Instead, gold purchases have been mainly by developing nation central banks such as those of India and Turkey, and, of course China. All of the latter have been quietly preparing to do what Russia did before the war: That is, de-dollarize by allocating capital into the one counterparty-free, seizure-free asset universally esteemed – gold.

As shown by the chart below, the combined efforts of just China and Russia have not been negligible Their combined holdings of dollar bonds have dropped by 20% in recent years, even as their combined gold holdings have risen by more than 80%.

Russia’s central bank in particular has been an aggressive buyer of gold, not seller. Accordingly, as Zero Hedge noted,

……if anything Biden’s decision will only make the gold market the latest to follow the example of oil and bifurcate: Cheaper for Russian-friends and much more expensive for Russian enemies.

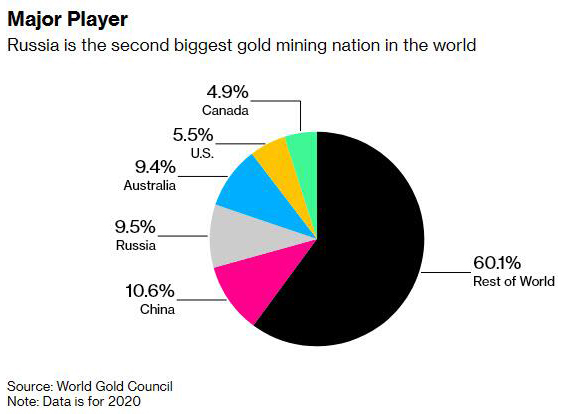

So, yes, Russia has become the #2 gold producer behind China, but the newly imposed gold embargo will hardly crimp its style. Russian gold miners mainly sold their gold to Russian commercial banks anyway, much of which sales ended-up at the Russian central bank.

In this context, Russia has also been among the top buyers of gold in the last ten years pushing its gold reserves from 883 tons at the end of 2011 to 2,302 tons at the end of 2021. Overall, the country has added more than 1,900 tons of gold since 2005, meaning that Russia’s gold reserves now constitute around one-fifth of its total reserves and are roughly equivalent to $140 billion.

So the gold embargo is likely to simply shift the direction of gold sales by Russian miners to non-aligned markets and to its own central bank. But the underlying valued-added to its economy from the near doubling of miner production in the last decade will hardly be impacted at all.

Russian Gold Production, 2010-2021

In all, Washington’s waves of penalties, ranging from sanctions on Russian officials and oligarchs to export controls to sanctions on major Russian banks, have not turned the ruble to rubble or even remotely crushed the Russian economy.

To the contrary, the

Russian ruble, which Biden gladly mocked back in February, has since risen to a

seven-year high against the euro.

As for "punishing" Russia, here is a chart of the US versus Russian current account balance: The record surplus belongs to Russia, the plunging deficit was made in Washington.

Current Account Surplus/Deficit: Russia Versus the USA, 1999-2022

At the end of the day, Washington has knee-capped western economies and American consumers especially. At the time of the February 24th invasion, the index of global commodities stood at 203, exactly at the economically-driven July 2008 global commodities peak.

Alas, the index now stands at 227 or nearly 12% higher. That’s surely a war premium – an extraction from prosperity every bit as unnecessary and stupid as Washington proxy war on Russia itself.

Global Commodities Index, 2003-2022

No comments:

Post a Comment