May 29, 2024

- UN says aid to Gaza has dropped 67 percent since Israel’s Rafah attack began

- US scolds Israel for ‘continued pattern of significant civilian harm’ in Gaza

- Brazil withdraws ambassador to Israel over war on Gaza

- Israeli military chief of staff visits Rafah, vows to ‘completely dismantle’ Hamas

- Israel must retain control of Philadelphi corridor ‘indefinitely’: Former Israeli PM Bennett

- Houthis claim downing of US Reaper drone

- Israeli forces seize control over Gaza’s border with Egypt with heavy fighting under way as troops push deeper in the civilian-packed west of Rafah city.

- At least 25 Palestinians are killed in incessant Israeli drone, artillery, and air strikes throughout the war-battered territory.

- The UN’s World Food Programme calls for an immediate truce in Gaza and warns its ability to help the starving and desperate people there is fading fast with “Rafah on fire”.

- At least 36,171 Palestinians have been killed and 81,420 wounded in Israel’s war on Gaza since October 7. The death toll in Israel from Hamas’s attack is at least 1,139 with dozens of people still held captive in Gaza.

Branko Marcetic

May 28, 2024

There is a dearth of hopeful

possibilities coming out of the Ukraine war these days, so it’s important to

make the most of them when they do emerge.

Case in point: last week, Reuters

published a report based on four sources “who work with or have worked with

[Russian President Vladimir] Putin at a senior level in the political and

business world” and are “familiar with discussions in Putin’s entourage,” who

told the outlet Putin was ready to negotiate an end to the war on the current

battlefield lines.

Significantly, when asked about the

report at a press conference, Putin said to “let them resume,” meaning peace

talks.

If true, this is yet another signal

coming out of Moscow in recent months that Putin is open to striking a deal to

finally end the war, albeit on the condition that Ukraine accept territorial

losses. As distasteful as that prospect is, the United States and its partners,

including the Ukrainian leadership, should urgently take this opportunity.

For one, we are already living

through the folly of ignoring the very real prospects for a negotiated end to

this war in 2022. The result has been disastrous for Ukraine.

Though the numbers are a state

secret, Ukraine has by now almost certainly suffered hundreds of thousands of

casualties. Its economy and infrastructure have been crippled, it is mired in

massive amounts of foreign debt, faces more than half a trillion dollars in

reconstruction costs, seen its democratic institutions degraded — all while

facing a social crisis from its rapidly aged and disabled population.

Worse, Ukraine has started losing

territory it gained back in its fall 2022 counteroffensive, as Russia has

leveraged its far bigger population and resources to slowly make gains. Western

intelligence agencies now reportedly expect the country to suffer “significantly

greater territorial losses” by the end of this year.

Meanwhile, the measures taken by the

Ukrainian leadership and its NATO partners to maintain the war effort are

becoming increasingly morally indefensible. As Kyiv puts its deeply unpopular

expansion of conscription into action — and as ordinary Ukrainians flee the

country, desert the military, or desperately avoid being snatched by military

recruiters and sent to die on the front line — a succession of NATO states,

including Poland and even some German officials, have talked about deporting

Ukrainian refugees, so they can be forced to fight.

Meanwhile, only 35 percent of those

not fighting feel ready to serve, and morale is rock bottom among the country’s

increasingly older, unhealthy recruits.

All the while, the war’s risk of

catastrophic escalation is creeping back to the high point it reached two years

ago, when President Biden warned the world was the closest to “Armageddon” it

had been in sixty years. With the United States and Europe looking at the

serious prospect of what the Economist recently called a “humbling episode”

that would be a “modern Suez moment,” officials have begun publicly floating

previously unthinkable steps to prevent a Ukrainian defeat, ones that have the

potential to trigger direct NATO-Russia hostilities.

Several NATO member states,

including France, have now publicly threatened to send troops into Ukraine.

Just yesterday, the Ukrainian military’s top commander officially permitted

French instructors to enter Ukrainian training centers, bringing the possibility

of Russian strikes killing NATO service members one step closer to reality.

At the same time, other alliance

officials, including Secretary General Jens Stoltenberg, are now warming up to

the idea of letting Kyiv use its Western arms to strike targets within Russia,

something the Kremlin has warned is “playing with fire.” We got a chilling idea

of what that might mean last Friday, when Ukrainian forces used drones to

destroy an early warning radar site in Russia.

The radar, warned Carnegie Nuclear

Policy Co-director James Acton, was a key part of Russia’s nuclear detection

and deterrence system that would have “only limited military benefit to Ukraine

and exacerbates nuclear risks.”

As Acton pointed out, attacks on

this system are explicitly listed as potentially justifying the use of nuclear

weapons in Russia’s military doctrine, just as they had been by the Trump

administration.

The potential for these and further

escalations will only grow in the months to come. As the U.S. election season

heats up, the political pressure to avoid the appearance of defeat,

humiliation, or loss of prestige — and so, the incentives to escalate in the

hope of forestalling one or all three — will only become more intense.

Taking advantage of Putin’s apparent

openness to a ceasefire and striking a deal now, however unpleasant, will be

better for everyone: for the state of Ukraine, for its people, and for the

safety of the entire world. To borrow words that were already once tragically

ignored, the Biden administration should now “seize the moment.”

John Ross

May 8, 2024

Superficially in the recent period

the U.S. has attempted to display two apparently contradictory sides of its

policy to China. First hand Treasury Secretary Yellen visited China, showing

off her (possibly genuine) like of Chinese food, engaging in a normal human way

with various Chinese people and audiences, and presenting herself as engaging

in generally calm tones on economic policy. Then, days later, Biden was staging

an openly anti-China summit in Washington, with Japanese prime minister Kishida

and Philippines President Marcos, and issuing political and military threats

against China—which led to China’s foreign ministry spokesperson Mao Ning

saying Beijing firmly opposes the relevant countries (i.e. the U.S.)

manipulating bloc politics, Liu Jinsong, director general of the Department of

Asian Affairs of China’s Foreign Ministry summoning the Chief Minister of the

Japan’s Embassy and making representations to the Philippine ambassador to

China, and to China’s Embassy in the U.S. lodging a solemn representation to

Washington. This was then followed by a visit to China by Secretary of State

Blinken in which he attempted to lecture China on international affairs.

In reality, this “soft cop/hard cop”

U.S. approach is not contradictory. It was two sides of the same coin. In

particular it is rooted in the real situation, as opposed to the myths

regarding, the U.S. economy and the implications of this for U.S. foreign

policy and domestic policy. These are rooted in the inability/refusal of the

U.S. to abandon its aggressive military and foreign policies and a similar

refusal/inability to carry out rational domestic transformations even of a

reformist kind. By these the U.S. dooms itself to defeat by China in peaceful

economic competition—with consequences which are examined at the end of what

follows. The bulk of this article, therefore, will analyse this fundamental

U.S. economic situation, in particular in its relation to China, and at its

conclusion it will look at the inevitable implications of this for geopolitics

and the forthcoming U.S. 2024 Presidential election.

Yellen’s visit revealed the real

situation of the U.S. economy

The mere five days of Treasury

Secretary Janet Yellen’s visit to China was sufficient to rip away hollow U.S.

propaganda and shone a clear light on the real state of both China and the U.S.

economies. The serious discussion around Yellen’s visit, because it went to the

core issues, in fact was a U.S. admission that:

China has a large lead globally in key industries for the next stage of

development of the world economy, and,

the U.S. is unwilling or unable, or both, to take the measures that

would allow it to compete successfully.

As the U.S. was unable to peacefully

compete with China it instead proposed, as on other issues, that China should

commit “economic suicide” to allow the U.S. to escape the consequences of its

own failures.

These economic issues also revealed

an inextricable interrelation to both U.S. foreign policy and its domestic

politics in the approach to the 2024 Presidential election. To analyse and

untangle these economic and geopolitical issues, we well as their interrelations,

we will start with the most immediate headlines and then trace the roots of

these in the most fundamental forces driving them.

Cutback on green energy

As was openly publicised the purpose

of in particular of Yellen’s visit, and a theme of Blinken’s, was to attempt to

persuade China to cut back on the “green” industries in which it has won an

overwhelming international lead. China has 80% of world production in solar

panels, 60% of wind turbines, and even the Western media acknowledges China’s

lead in EV and other battery production. Interrelated with this, in 2023 China

became the world’s largest car exporter and in particular has the world’s

leading position in EV vehicles—motor exports being previously an industry

dominated by the high-income economies of Japan and Germany.

These issues, which grabbed media

headlines, followed on from the publication of economic data for 2023 from the

world’s main economies which showed the absurdity of recent claims in the U.S.

media such as the Wall Street Journal’s that “China’s economy limps into 2024”

whereas the U.S. was marked by a “resilient domestic economy” or the Washington

Post’s claim “in the United States… the surprisingly strong economy is

outperforming all of its major trading partners”. In fact, China’s GDP growth

in 2023 was 5.2% in 2023 compared to 2.5% for the U.S.—China’s economy grew

more than twice as fast as the U.S. This continued the trend over the entire

four-year period since before the pandemic struck—during which period China’s

20.1% growth was two and half times that of the US’s 8.1%. This and other data

was analysed in detail in 比较中国经济,某些人是如何做到“谣谣领先”的

The green transformation of the base

of the world economy

But Yellen’s visit generated more

headlines than did statistical data not simply because specific products such

as cars, solar panels or electric batteries, are more immediately tangible and

understandable to the general public than abstract concepts such as GDP. The

practical reality, which directly touches billions of people, is that the

entire world is going through the biggest change in its energy supply, one of

the core foundations of its economy, since at least the beginning of the 20th

century—when there occurred the beginning of mass electrification and the

introduction of oil powered vehicles. In a more profound sense, this is the

biggest transformation in this field since the Industrial Revolution created

the beginning of a world energy supply based on fossil fuels—for most of the

19th century coal and then in the 20th century a mixture of coal, oil and gas.

Numerous international agreements

and practical actions by national governments of course now internationally

acknowledge that if catastrophic climate change is to be avoided the entire

basis of the world’s energy supply will have to be rebuilt. The realisation of

this is leading all major economies, including the U.S. and China, to make a

transition towards renewable energy supplies—which, in the end, will involve

expenditures of tens of trillions of dollars.

China’s emergence as the world’s

leading supplier of green energy products therefore alters its relations with

the world economy. Although since 2013 China has been the world’s largest goods

trading nation its previous dominance was frequently most directly seen in

fields such as medium technology or consumer goods. But the development of its

new green productive forces means that China’s products are becoming

increasingly essential for, and therefore integrated into, the whole process of

production in other countries.

The international division of labour

Given the gigantic scale of this

international economic transformation the claim by the U.S. that what is

occurring is a global threat of “over production” in green products is

evidently absurd—as numerous commentators have observed. On the contrary, what

exists globally is a threat of insufficient production to make the shift in the

necessary time period.

As China’s Vice Minister of Finance

Liao Min stated: “Taking new energy vehicles as an example, according to the

International Energy Agency, global demand for new energy vehicles will reach

45 million units in 2030, which is 4.5 times that of 2022; global demand for

new photovoltaic installed capacity will reach 820 GW, which is 4.5 times that

of 2022. The current production capacity is far from meeting market demand,

especially the huge potential demand for new energy products in many developing

countries.”1

Given the enormous scale of this

global transformation taking place simultaneously in numerous fields it is

quite clear that no single country, not even China or the U.S., can by itself

meet this demand. Numerous countries will, and are, participating in this

transition in different forms. Different countries will find different places

in this transition according to relative advantages and efficiencies. As Vice

Minister of Finance Liao Min stated: “production capacity issues should be

analysed based on the global division of labour and international market

conditions.”2

Similarly the U.S. claim that China

should limit production to simply the scale of its domestic demand is

ridiculous and is not in slightest followed by U.S. companies

themselves—Reuter’s noted: “Yellen used her second trip to China in nine months

to complain that Beijing’s overinvestment has built factory capacity far

exceeding domestic demand.” There are numerous industries in which, for

example, the U.S., Germany or Japan are enormous exporters because they have

relative advantages in these industries—in the case of the U.S. these include

agricultural products, civil aircraft, financial services and armaments to name

only a few.

Technology boycotts

It equally follows that the idea

that a country should be in balance in trade in each sector of its economy is

also absurd it was refuted 250 years ago in the founding work of modern

economics, Adam Smith’s The Wealth of Nations. On the contrary, different

comparative advantages of different economies in different types of production

is one of the foundations of global economic development and is a fundamental

basis of high levels of international productivity and living standards.

Different economies have different advantages in different spheres of

production and therefore every country gains by specialising in these—while, in

sectors in which they are less efficient they, it imports products from

countries which are more efficient in these. These questions are clear and have

been understood since the birth of economics. They form one of the key bases of

the international economy.

Thus, for example, as Vice Minister

of Finance Liao Min stated: “The economies of China and the United States are

highly complementary, and the essence of economic and trade relations is mutual

benefit and win-win.”3 To take practical examples, China is certainly the world

leader in many sectors of green technology, but U.S. and Western companies at

the present time retain a lead over China in production of advanced microchips

and other industries. The most rational basis for development on both sides is

therefore for these economies to export to each other the products in which

they are most efficient and to import from other countries products which they

can produce more efficiently. It is the U.S. which obstructs this through its

tariffs, technology boycotts etc.

Instead, the U.S. is pursuing what

is unfortunately a “lose-lose”—although one in which in the medium/long term

the U.S. loses more than China. For reasons that are analysed below China has

the resources to develop high tech spheres of production in which the U.S. is

currently more dominant—signified dramatically, for example, in the highly

successful launching of the Huawei Mate 60 Pro, openly signifying U.S. failure

to destroy the mobile phone business that company via technology sanctions. In

these sectors, China in the short term, of course, has to bear the cost of

devoting extra resources to R&D to develop such technologies—the reasons

why it can finance this are also analysed below. But in the medium/long term it

is numerous U.S. and other companies participating in chip and technology

boycotts against China that will be the losers because, due to the development

of China’s alternatives, they will permanently lose markets for their products.

China’s balance of payments and

globalization

It also follows from this long

understood reality of comparative advantage and efficiency that it is

ridiculous to believe there should be balanced trade in each sector of a

country’s economy. Instead, the reasonable international demand, which is

indeed adopted by international organisations, is that at least regarding major

economies overall trade of countries should be in relative balance—that is they

should not be running excessive overall balance of payments surpluses or

deficits. This is clearly the case with China. In 2023, China’s current account

balance of payments surplus was 1.5% of GDP—a surplus of 1,861 billion yuan

compared to GDP of 126,058 billion yuan. This was actually a reduction from

China’s 2.4% of GDP balance of payments surplus in 2022—although both are in an reasonable range by international criteria.

In fact, because even a cursory

examination shows that its overall economic arguments make no sense, what the

U.S. is worried about is its decreasing ability to maintain its position at the

high end of the value chain in international trade in a widening range of

products. The U.S. idea in globalisation was that it would occupy the leading

position in the high technology/high value added industries and developing

countries, including China, would have low and medium technology and value

added industries. Correspondingly the standard of living would be high in U.S.

and lower in developing countries. But, instead, China is breaking into high

technology high value added industries with corresponding sharp rises in its

people’s standard of living.

This in turn, of course, crucially

poses the question of why the U.S. in finding itself increasingly unable to

compete? It is here that the illusions of the U.S., its myths about itself, and

its corresponding inability to accurately analyse problems, and therefore to

overcome them, comes in. It is indeed extremely difficult for the U.S. to

accurately analyse the situation because, to do so, it would have to break with

delusions of U.S. supremacy and Western arrogance—something which it is very

difficult psychologically and politically.

Why the U.S. finds it increasingly

difficult to compete

To understand why the U.S.

increasingly cannot win in peaceful competition it is necessary to analyse

economic fundamentals. The U.S. authorities at present are incapable of doing

this because they insist on putting forward myths which, as they conceal reality,

make it incapable of focussing on its real problems. For example, the U.S.

frequently claims that it will lead the world economy because it is uniquely

“creative”, “innovative”, “entrepreneurial” etc. This is simply a myth.

Certainly, the U.S. has extremely talented/skilled scientists, engineers,

technical specialists, business leaders etc. But so does China—and India, South

Korea, and other countries, and the idea that Americans are somehow more

intelligent or motivated than those in other countries is simply an example of

unfounded arrogance.

Attempts to present similar claims

in a supposedly non-arrogant/non-racist way, by statements that U.S.

institutions are superior to those of other countries, are also being tested

and being shown to be false. Periodic gridlocks between different branches of

U.S. government; extreme clashes between supporters of Trump and Democrats;

widespread belief in fraudulent claims such as that Trump really won the 2020

presidential election; the physical attack on the U.S. legislature on 6 January

2021; the glaringly disproportionate role of money in the U.S. political

system; increasingly frequent delivery by the U.S. electoral college of the

Presidency to candidates defeated in the popular vote; the ability of the

non-elected Supreme Court to over-rule both the legislature and overwhelming

public opinion; all reflected in polling showing overwhelming lack of

confidence of the population in U.S. political institutions, and a clear

majority believing the country is going in the wrong direction, are signs of a

dysfunctional not a well-functioning institutional system. In contrast even

polls conducted by U.S. institutions find that the population of China believes

its country is going in the right direction.

Regarding analysis and ideology, it

is Chinese Marxism which delivered in China the greatest improvement in the

living conditions of the largest number of people in human history. The U.S.

simply does not have concepts in its “zero-sum” approach which allow reality to

be as clearly understood as those, for example, of the “common destiny of

humanity” or “common prosperity”. Factually, having achieved moderate

prosperity by its national standards China, either next year or the one after,

will achieve the World Bank standard of a high income economy. China will, with

18% of the world’s population, have delivered the advantages of living in a

high-income economy to more people than all other countries in the world put

together—the latter make up only 16% of the world’s population.

The U.S. administration cannot even

acknowledge or consider the implications of such facts because to do so it

would have to abandon the dreamland of myths to face the realities of the

world. But, as U.S. founding father, and second President, John Adams,

accurately noted: “Facts are stubborn things; and whatever may be our wishes,

our inclinations, or the dictates of our passions, they cannot alter the state

of facts.” Unless the U.S., or any other country, is prepared to begin to

abandon myths and face economic facts it will have the utmost difficulty in

solving its problems.

The development of large economies

Turning now to the real determinants

of economic development as opposed to myths, particularly as regards the U.S.,

naturally all countries are specific and represent unique combinations of

factors. China, the U.S., Japan, and Germany, to take only the four countries

which together account for the majority of world GDP, are very different. But

the facts demonstrate that they, and indeed all large economies, have common

features. In particular, for present purposes, the facts clearly show that

while numerous factors affect short term economic developments, of decisive

importance in the relations of the U.S. and China is that the medium/long term

growth of large economies shows an extremely close correlation between the

proportion of their economy devoted to net fixed capital formation and their

rate of economic development (net fixed capital formation is new investment

minus the consumption of existing fixed investment through depreciation—that is

the addition to the capital stock).

In order to avoid misunderstanding

it should be stressed that this correlation only applies to larger economies,

it does not apply to a number of small economies in which other factors,

including the impact on them of large economies, can play a decisive role. But

the latter point is irrelevant to both the U.S. and China as they are above all

the examples of large economies—the world’s two largest economies.

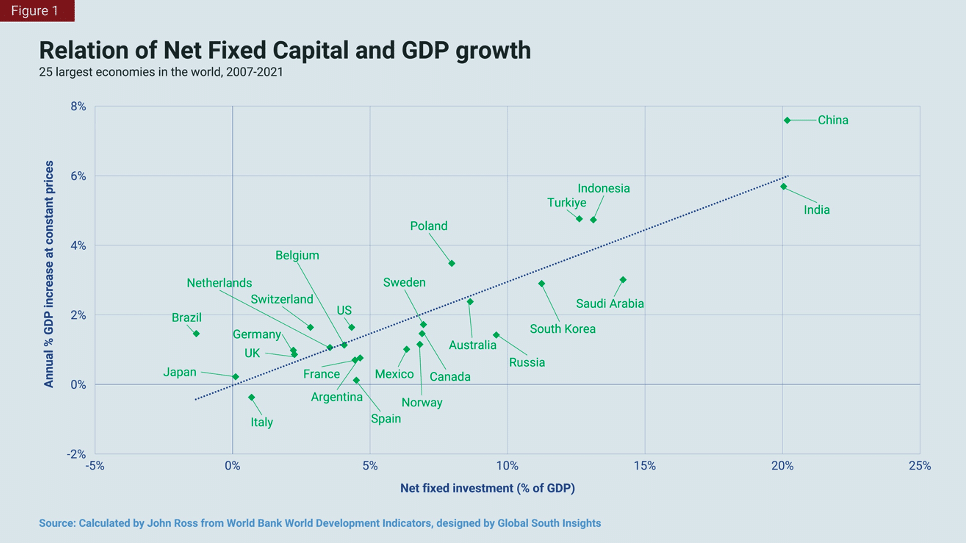

To show this, Figure 1 demonstrates

the pattern of growth, the relation of net fixed investment and GDP growth, in

the world’s 25 largest economies over the entire period since the beginning of

the international financial crisis in 2007 to the latest internationally

comparable data for 2021. These economies together account for 83% of world

GDP—therefore entirely dominating world economic development. Their similarity

in this feature is overwhelming. The correlation between the percentage of net

fixed investment in GDP and GDP growth in the world’s 25 largest economies is

an astonishingly high 0.89 and the R squared is 0.79. In the real world this is

as close to a perfect correlation as is likely to be found in any phenomenon.

This close relation immediately

flows, in Marxist terms, from Marx’s analysis that the driving force of

economic development is increasing socialisation of labour—fixed investment

being simply socialisation of labour across time, i.e. the use of products of

previous production cycles in the present production cycle. However, to focus

attention on the facts, and make their consequences available also to those who

do not accept a Marxist analysis, the terminology of “Western economics” will

be used in what follows—anyone wishing to instead substitute Marxist

terminology may easily do so.

This data above makes it immediately

obvious why the world’s fastest growing major economies are China and

India—they have by far the highest percentages of net fixed investment in GDP.

The same relation similarly shows why other major Global South economies, such

as Indonesia and Turkiye, are growing much more rapidly than the U.S. or the

rest of the G7—these key Global South economies have far higher levels of net

fixed investment than the Global North.

Taking an example from East Asia,

this same process explains why a country such as South Korea, historically much

poorer than Japan, is so rapidly catching up with Japan—in 2007 South Korea’s

per capita GDP, at current exchange rates, was only 67% of that of Japan

whereas by 2022 it was 95%, and in PPP terms South Korea’s per capita GDP was

actually 10% higher than Japan’s. These different results are explained by the

fact that Japan’s level of net fixed investment has fallen to only 0.1% of GDP

while South Korea’s was 11.1% of GDP—in line with this from 2007-2021 Japan’s

GDP grew at an annual average rate of 0.2% while South Korea’s grew at 2.9%.

Finally, regarding this point, it is

necessary to clear up some confusions, reflecting “vulgar” economics. This

decisive role of net fixed investment in the economy is not counterposed to,

but on the contrary is the essential complement, to “innovation”—an innovation

which remains purely an idea does not produce anything, but it has to be

embodied in production which will require investment (computers, microchips,

solar panels, EV vehicles etc). Second, vulgar economics confuses the physical

and economic meaning of the term “factor of production”—but on this issue it is

the economic, the value, meaning which is decisive not the physical one. For

example, a microchip is physically tiny but its value is enormously higher than

a physically large product such as coal. Similarly high value-added products,

requiring large investments to manufacture, such as solar panels, efficient

batteries, etc far from being environmentally damaging actually are fundamental

to safeguarding the environment.

China, like a number of, but

unfortunately not all, major economies, is rightly turning away from methods of

production which require huge accumulation of physical, and frequently

environmentally damaging, factors of production—coal, fossil fuels, damage to

large areas of land etc. But the products that are superseding these are in

economic terms even higher value added than those which they are

replacing—investment to open a coal mine is, for example, tiny compared to that

required to construct a microchip factory or manufacture the most advanced form

of batteries.

Causation and correlation

Turning to the practical

implications of these facts for the U.S. and China, Marxist and serious Western

economic theory, such as growth accounting, of course predict the factual

relation shown above. They both analyse fixed investment (capital) as a key

input into production. The direction of causality Marxism and serious Western

economics therefore gives for the correlation is clear—increasing the level of

net fixed capital formation in the economy will increase economic growth. But,

for present purposes, it is not even necessary to discuss the question of

causality. Such extraordinarily high correlations as those above simply mean

that it is impossible to substantially raise the rate of economic growth of

large economies without raising their proportion of net fixed investment in

GDP—and any fall in the share of net fixed investment will be accompanied by a

fall in the rate of economic growth.

The choices facing the U.S.

Now turn to the precise consequences

of these facts for the U.S. The facts on the U.S. economy show that a strategy

of competing with China by increasing the efficiency of U.S. investment is in

reality entirely impractical. The reason for this is that China and the U.S.

have, in international terms, high levels of efficiency of capital in producing

economic growth—China among developing countries and the U.S. among advanced

economies. The Incremental Capital Ratio (ICOR)—for non-economic specialists

that is the amount of GDP that has to be allocated to gross fixed investment

for their economies to grow by 1%—is 8 in the case of China and 10 in the case

of the U.S. The lower the number the more efficient is investment in producing

growth and the detailed comparisons may be found in “Why China’s socialist

economy is more efficient than capitalism”. Both are highly efficient in

producing growth in their respective categories.

Turning to net fixed investment’s

efficiency in producing economic growth, the U.S. only uses 2.6% of GDP as net

investment to grow its GDP by 1%—which is significantly more efficient than the

median for the 25 largest economies of 3.5%. Given that U.S. investment is

already efficient, realistically the only way in which the U.S. could

substantially increase its economic growth rate is by increasing the percentage

of net fixed investment in GDP. The very close correlations already shown then

in turn make it possible to rather simply determine the orders of magnitude

involved to achieve this—and immediately shows why they are inescapable

interrelated with U.S. foreign and domestic policy.

Assume that the U.S. maintains this

high level of efficiency of use of investment in generating economic growth. In

2007-2021 U.S. net fixed investment averaged 4.3% of GDP and its annual GDP

growth rate was 1.6%—i.e., as noted earlier, U.S. GDP grew by 1% for every 2.6%

of net fixed investment in GDP. To avoid the suggestion that this number is

strongly affected by the period examined, shorter periods, for example, to

avoid the effects of the financial crisis, produce merely marginal

differences—taking the 10 years to 2021, for example, merely leads to a number

of 2.5% instead of 2.6%.

To calculate from this U.S.

potential economic growth rates, in the period 2007-2021 U.S. consumption of

fixed capital (depreciation) was 16.1% of GDP and gross fixed capital formation

was 20.5%—resulting in, rounding to one decimal point, 4.3% of net fixed

investment in GDP. As the U.S. uses 2.6% of net fixed investment for its GDP to

grow by 1%, assuming that the level of depreciation remains the same, and there

is no realistic way to decrease this, then to increase U.S. net fixed

investment to 8% of GDP would require U.S. gross fixed investment to rise from

20.5% of GDP to 24.1% —a 3.6% of GDP increase. With the same correlation of net

fixed investment and GDP growth, of 2.6% of GDP having to be used to generate a

1% GDP increase, then in this case U.S. annual average GDP growth would

increase to 3.1%. To raise U.S. net fixed capital formation to 10% of GDP, the

share of gross fixed investment in U.S. would have to rise to 26.1% of GDP,

that is by 5.6%. If that were achieved, then annual U.S. GDP growth would be

3.8%.

These are certainly significant

increases, but examination of the internal structure of the U.S. economy makes

clear that they are not impossible. But they would, however, require major

changes in policy and the problem is that the U.S. has shown itself unwilling

to make these.

Means to achieve an increase in the

proportion of the U.S. economy devoted to net fixed investment

To understand the type of policy

choices involved recall that investment and consumption make up 100% of the

domestic economy. Therefore, ignoring inventories, which form an extremely

small part of the economy, increasing the level of fixed investment in U.S. GDP

would necessarily require reducing the proportion of consumption. The only

choice would be which form of consumption would be reduced.

One possibility, evidently, is to

significantly reduce households’ percentage of consumption in the U.S. economy.

But this would mean a sharp short-term reduction in household consumption, and

therefore U.S. living standards, which would be very unpopular—very difficult

for a U.S. administration to gain assent to. But there are other ways to reduce

the share of consumption in the U.S. economy, and therefore raise the U.S.

investment rate, without decreasing the share of household consumption.

The first is military

spending—military spending in economic terms is overwhelmingly a form of

consumption (on official U.S. data 78% of U.S. military spending is

consumption). In 2023, on its official figures, U.S. military spending was 3.6%

of GDP—$995 billion. Reduction of U.S. military spending would, therefore,

release very considerable resources for U.S. investment. For example, reducing

U.S. military expenditure to the 2% of GDP which it is the level the U.S. urges

for its NATO allies, would release 1.6% of GDP for investment—almost half of

the resources required to raise U.S. net fixed capital investment to 8% of GDP.

In reality, there is considerably

greater scope for savings as U.S. official data substantially understates its

level of military spending by excluding items such as military pensions, debt

payments on borrowing for military expenditure etc from its official data. As

the recent study of the U.S. national accounts by Gisela Cernadas and John

Bellamy Foster found, in 2022 real U.S. military expenditure was $1,537 billion

(or 5.6% of GDP) as opposed to the official figure of $928 billion (or 3.6% of

GDP).

The second area in which the U.S.

could release huge resources for investment is in health spending due to the

extraordinarily inefficient U.S. health system. The U.S. private health system

uses by far the highest proportion of economic resources, for the worst

outcome, of any comparable economy. World Bank data shows that in 2019, before

the huge increases in expenditure in almost every country due to the impact of

Covid, 16.7% of U.S. GDP was spent on health—compared to, for example, taking

economies at comparable levels of development, 11.7% of GDP in Germany, 11.1%

in France, 10.8% in Japan or 9.9% in the UK.

But the outcomes of this private

U.S. health system are far worse than in other countries—U.S. life expectancy

in 2019 was 78.8 years, compared to 81.3 years in Germany, 84.4 years in Japan,

81.4 years in in the UK, or 82.3 years in France.

Adopting the public centred health

systems used in other countries would release enormous resources to increase

U.S. investment. For example, reducing U.S. health expenditure to German levels

would release 5% of GDP—or by itself enough to raise the U.S. level of net

fixed investment to 8% of GDP. A combination of reducing U.S. military

expenditure, and rationalisation of its extraordinarily inefficient health

system, would easily release sufficient resources to hugely increase U.S.

investment.

In summary, in looking at how to

increase U.S. economic growth rates and competivity, it might be too radical a

solution for the U.S. to adopt socialism! But the acute form of these problems

for the U.S. arises from the fact that it won’t even undertake rational reforms

within the framework of the capitalist system.

In turn, the reason the U.S.

administration is unwilling/unable to undertake these changes is because they

would require changes in U.S. foreign and domestic policy. Significantly

reducing military expenditure would put pressure on the U.S. to make its foreign

policy less aggressive. Rationalising the U.S. health system, moving towards

the more successful ones of other comparable countries, would require

confronting vested interests among U.S. private health providers and using

elements of public supply of health services which are declared to be

unacceptably “socialist” by U.S. ideology.

In short, the increasing inability

of the U.S. to compete in investment in developing new industries is not due to

China, it is due to its own economic choices. The problem is made in

Washington, not in Beijing.

Equally, of course, anyone in the

U.S. who wants reforms to develop green industries, good jobs and peacefully

competitive industry will point out the changes in U.S. military, foreign and

health policies these require. The U.S. problems in these key fields are not

because of China but because the U.S. refuses to change its military policy,

its foreign policy, or its extraordinarily inefficient health system.

U.S. losing its competitive position

Finally, to bring these

macro-economic issues down to the company/industry level, consider their

financial implications—which leads directly to the core question.

Macro-economically all investment must necessarily have an equal quantity of

savings/capital creation (here it should be noted that, in economic terms,

savings are not simply those by households but also those from company profits

and any by government—in practical terms savings by governments are typically

negative, due to their budget deficits).

In every major economy the

overwhelming majority of such savings/capital creation are from within their

own economy. The U.S. is unusual in that in 2023 it used $845 billion from

abroad, equivalent to 3.1% of GDP, to finance its investment but this still

means that 84% of U.S. gross fixed investment was financed domestically. The

low level of fixed investment in the U.S., compared to China, therefore

reflects the U.S. low level of capital creation/savings—in 2022, the last year

for which there is internationally comparable data, China’s capital

creation/savings was 47.0% of GDP compared to 17.1% for the U.S.

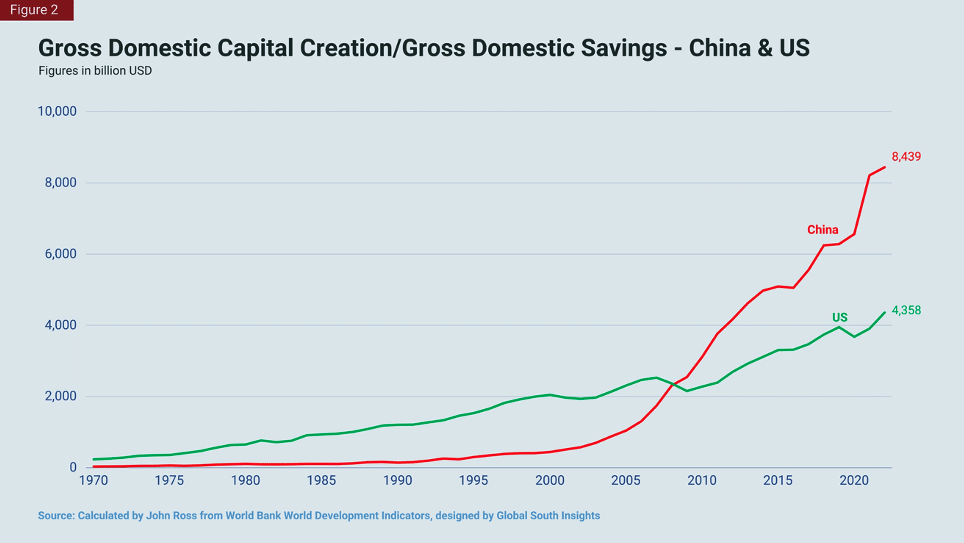

To accurately assess the enormous

impact of this on international economic competition a more illustrative

measure is to show this in in dollar terms. Figure 2 shows that in 2022 China’s

capital creation/savings was $8.4 trillion compared to $4.6 trillion for the

U.S. In absolute terms China’s savings/capital creation was therefore 194%,

that is almost double, that of the U.S. Indeed, China’s capital

creation/savings is larger than the U.S. and the Eurozone combined.

U.S. lack of competivity spreads to

new industries

It is China’s huge lead in capital

creation/savings available for investment that in turn makes possible its lead

in the development of new industries. And it is the lack of such resources

which means that the U.S. finds itself unable to compete in a steadily widening

range of industries.

Every new industry, every new

productive force, requires investment. China therefore has an unequalled

ability to allocate resources to such emerging new industries. As Vice Minister

Liao Min put it: “China’s new energy industry has experienced rapid development

for decades. Its current competitive advantages are rooted in China’s

large-scale market advantages, complete industrial system and abundant human

resources. It is also inseparable from the huge investment in R&D and

innovation by enterprises and the unremitting efforts of entrepreneurs.”4

The U.S. is falling behind in

creating such resources for investment and therefore has increasing difficulty

to allocate them to new industries. Furthermore, as already seen, the U.S. is

unwilling to take the steps that would create the resources that would allow it

to do so.

This process creates the powerful

development of new productive forces in China—China’s transition to becoming a

technological leader. This process is, consequently, inevitable spreading out

from one industry to many. It was already achieved in telecommunications—U.S.

sanctions against Huawei are in fact an admission Western companies cannot

compete with it. Furthermore. telecommunications is integral to the development

of a whole series of IT sectors. China’s lead in green power, battery

production and motor exports has already been noted. In consumer products the

attempt to ban TikTok is once again a U.S. admission that it cannot compete

with what is now one of the world’s leading retail products. China and the U.S.

are the world’s two leaders in Artificial Intelligence.

But inevitably this process will not

stop at its present stage. There will inevitably be the emergence of new

industries, technologies, and products which are not yet even invented. China

has the resources to invest in these on a scale which the U.S. does not.

If the U.S. already finds China in

the technological lead in a number of industries today, then in the future it

will be in many more. And while the U.S. can take action against individual

companies today, such as Huawei or TikTok, in the future the processes already

outlined mean China will have far too many such companies for this to be

effective. What was originally U.S. attempts to suppress one or two companies

will begin to come close to suppressing whole new industries in which they U.S.

cannot compete—the world is already halfway there in this in the case of

renewable energy for example.

The U.S. also finds itself in an

increasingly difficult situation due to the wholly global development of new

industries. If the U.S. decides to lock its own economy into high

cost/relatively inefficient production behind tariffs, there may be nothing China

can do about it except point out the self-harming character of such

developments. But most of the world, outside the closest circles of U.S.

allies, won’t go along with it. Why should any country aiming at national

development decide to purchase more expensive products from the U.S. when

products with exactly the same technical capacity, and in a number of cases

superior ones, can be obtained from China? Even if the U.S. decides to cut

itself off from China, and even this is by no means practically easy to

achieve, as long as China maintains its present dynamic the majority of the

world economy will not.

The U.S. situation is worsening

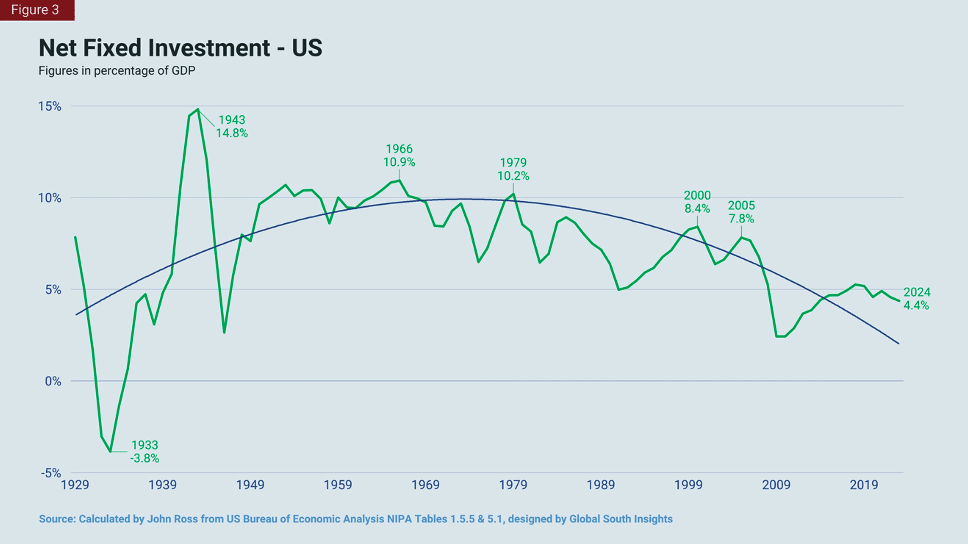

What makes this situation more acute

is that the U.S. position is deteriorating, not improving. To see this Figure 3

is the most important graph to understand the US’s economic rise and fall over

the last century. It can be easily seen that at the peak of its power, as it

emerged from the Great Depression, World War II, and during the post-World War

II economic boom, U.S. net fixed investment as a proportion of its economy did

in fact reach the levels for more rapid economic growth analysed above. In 1943,

at the peak of the U.S. World War II boom, the fastest period of economic

growth in its entire history, U.S. net fixed investment rose to 14.8% of GDP.

In 1966, during the post war boom, U.S. net fixed investment was 10.9% of GDP.

But by 2023, after almost six decades of decline, U.S. fixed investment had

fallen to a mere 4.4% of GDP. Due to the processes analysed above, unless the

U.S. reverses this trend it is incapable of regaining rapid economic growth or

to have the resources to successfully compete in a widening range of new

industries.

The U.S. is locked into slow

economic growth

The practical consequences of this

economic trend in terms of development are clear. It is an inevitable result of

the relations note above, that as the proportion of net fixed investment in

U.S. GDP fell so also did its economic growth rate. Figure 4 shows this

process, with the long-term annual rate of U.S. GDP growth declining

inexorably, as its net investment as a share of its economy fell, from 6.3% of

GDP in 1953, to 4.4% in 1969, to 4.0% in 1978, to 3.5% in 2002, to 2.1% in

2023. As the U.S. is unwilling to take the measures to raise its level of net

fixed capital formation in GDP the factual relations above mean it is

inescapably locked into a slow growth rate and having increasing difficulty in

financing development of new productive forces.

Therefore, try to persuade China to

commit suicide—consumption

Finally on these directly economic

issues, as the U.S. is unwilling/unable to take the measures to increase its

level of net fixed investment in GDP and has no way to “murder” China’s

economy, the only way the U.S. can attempt to compete with China is to ask

China to commit economic “suicide”. Specifically, this means, that China should

reduce its level of investment down towards the level of the U.S. As the U.S.,

evidently, cannot openly ask China to do this as a proposal to commit economic

suicide, the U.S. instead puts this in the form of asking China to raise the

proportion of consumption in its economy—as consumption and investment together

make up 100% of the domestic economy increasing the percentage of consumption

in GDP necessarily means reducing the proportion of investment.

An extended analysis of this issue

was given in “So-Called ‘Peak China’ Is Simply a Western Campaign for China to

Commit Economic Suicide” so it is unnecessary to repeat this here. It is

sufficient to note that in her visit to China Yellen continued this line of

attack. As the New York Times noted: “During her meetings with her Chinese

counterparts, Ms. Yellen tried to argue that China should focus more on…

consumption.” The Washington Post similarly emphasised that Yellen argued:

Chinese authorities should boost domestic

consumption.

Conclusion—implications for U.S.

foreign policy and domestic politics

We will conclude briefly with the

implications of this for U.S. foreign and domestic politics.

The best interests of the world,

China, and the U.S. people would clearly be served by U.S. administrations

abandoning their “zero-sum” approach to international relations and

understanding, as demonstrated in China’s central foreign policy concept of the

“common destiny of humanity”, that

cooperation between countries is the best basis of mutual advantage and

advance. But, as at present, U.S. governments are not prepared to do this, the

US’s successive lines of attack on China flow inevitably from the situation

which was seen above and explain its recent diplomatic and other actions.

First, for the reasons analysed

above, unless the U.S. undertakes the types of economic change which will

produce a sharp increase in its level of investment, and if China refuses to

change course to commit economic suicide, then the defeat of the U.S. in

peaceful economic competition is inevitable.

Second, as the U.S. has been

unwilling/unable to take the necessary economic measures required for success

in developing new global industries, the US’s least risky choice, at present,

to try to win in such competition, is to attempt to persuade China to commit

economic suicide by a radical increase in the share of consumption in its

economy radical reduction in its level of investment. The U.S. realises it

faces formidable obstacle in this because Xi Jinping has stressed that China

must base itself on Marxist economics, “our study of political economy must be

based on Marxist political economy and not any other economic theory”,5 and

even serious “Western” economics totally contradicts the policies which the

U.S. is urging on China—for a detailed analysis of this see “So-Called ‘Peak

China’ Is Simply a Western Campaign for China to Commit Economic Suicide”. But,

nevertheless, the U.S. hopes that some combination of confused theories,

comprador elements, those who wish to emulate Russian oligarchs who became rich

through the national catastrophe of Russia, or other forces might be able to

persuade China onto such a path. It was to encourage this that Yellen was

attempting to spread confusion and damaging economic policies during her visit.

As other alternatives are more dangerous for the U.S., and external economic

sanctions are not powerful enough to derail China, then for a period the U.S.t

is likely to continue to have as its main tactic this attempt to get China to

commit economic suicide.

Third, however, the U.S. is likely

to fail in this course. Therefore, it has to prepare more dangerous options

both for everyone else—and also for itself. These options flow from the fact

that while the U.S. is losing in peaceful economic competition it still

possesses the world’s most powerful military—U.S. military spending is larger

than the next nine countries put together. However, this situation will

inevitably change, including in the nuclear field, as China’s economic success

translates into military strengthening—and given the U.S. record of military

aggression in Korea, Vietnam, Iraq, Libya and elsewhere the threat of its own

nuclear annihilation is the most trustworthy restraint on the U.S. In the

present situation, the danger is that the U.S. will decide it will take the

risk of military or military related solutions before it loses its lead in this

field. Such a course, of military related actions around China’s Taiwan

Province, or even war, is actively advocated by a minority within the U.S. foreign

policy/military mainstream. It runs in parallel with policies such as the

provocations in the South China Sea symbolised by the recent

U.S.-Japan-Philippines summit. How to deal with military related threats is, of

course, only a matter for China itself and requires information only available

to a country’s leaders. But in general, viewed from outside, given the military

threats from the U.S. it is evident that the attention being paid by the

leadership of the CPC to national security is entirely justified.

Fourth, this increasing turn of the

U.S. to military related policies is both leading to international crises and

has a major impact in U.S. domestic politics. Numerous U.S. experts on Eastern

Europe warned that the attempt by the U.S. to expand NATO up to the borders of

Russia would inevitably lead to a deep crisis. This duly broke out in Ukraine

in the largest war in Europe since 1945, but one which at present Russia is

winning. In West Asia (the “Middle East”), U.S. support for Israel’s polices,

including that country’s most extreme government ever under Netanyahu, led

first to armed conflict on 7 October and now to the prolonged war in Gaza and

the massacres carried out there by Israel. These actions by Israel, in turn,

have led not only to immense human suffering but also extremely widespread

global revulsion against its policies, and therefore international isolation of

the U.S. for supporting and providing the means for Israel to carry out these

actions. These unfolding massacres in Gaza have in turn now created widespread

opposition to Israel’s policy even within the U.S. itself.. In short, an

increasing resort to military related solutions, has damaged the U.S.

internationally and is impacting U.S. domestic politics and the 2024

Presidential election. Unfortunately, however, instead of retreating from such

policies, and addressing itself to dealing with its real economic problems,

analysed above, the U.S. is attempting to double down on aggressive military

related policies— as shown at the Philippines-Japan-US summit and in proposals

to expand the AUKUS alliance to include Japan.

Therefore, as stated at the

beginning of this article, Yellen’s visit and the bellicose rhetoric of the

Biden-Kishida-Marcos summit are not contradictory but are the two sides of the

same coin inevitably produced by the fundamental economic situation of the U.S.

The Chinese version of this article

was originally published at Guancha.cn.

Notes:

1. ↩ 财政部副部长廖岷就美国财政部部长耶伦访华情况向媒体吹风并答问 https://www.guancha.cn/internation/2024_04_08_730981.shtml

2. ↩ 财政部副部长廖岷就美国财政部部长耶伦访华情况向媒体吹风并答问 https://www.guancha.cn/internation/2024_04_08_730981.shtml

3. ↩ 财政部副部长廖岷就美国财政部部长耶伦访华情况向媒体吹风并答问 https://www.guancha.cn/internation/2024_04_08_730981.shtml

4. ↩ 财政部副部长廖岷就美国财政部部长耶伦访华情况向媒体吹风并答问 https://www.guancha.cn/internation/2024_04_08_730981.shtml

5. ↩ Xi, J. (2020, October 11). Opening Up New Frontiers for

Marxist Political Economy in Contemporary China (November 23, 2015). Retrieved

from Qiushi: http://en.qstheory.cn/2020-11/08/c_560906.htm

No comments:

Post a Comment